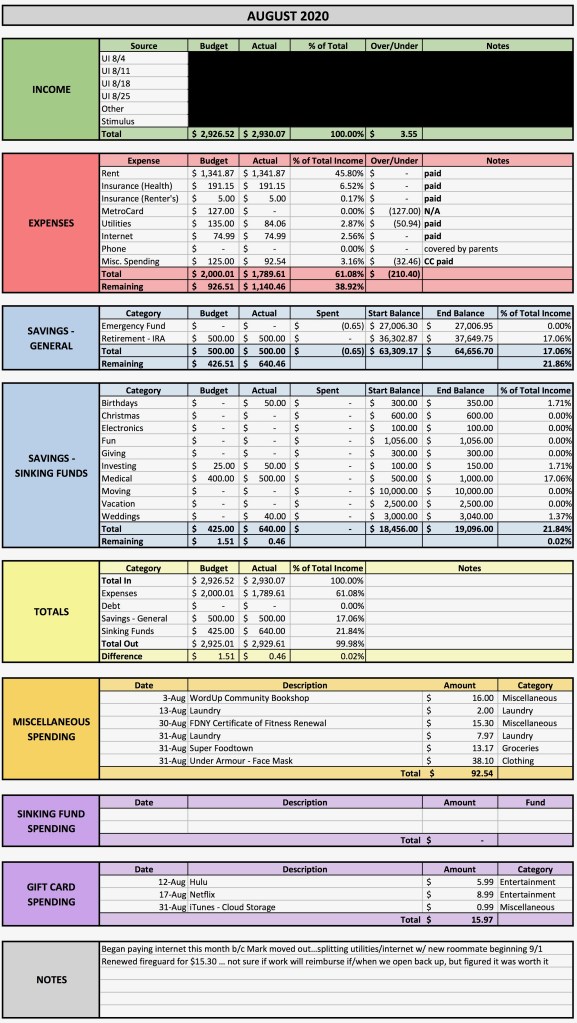

Another month has gone by, another summer is over, and it’s time for another budget report. For me, August 2020 looked quite different from any other. I didn’t indulge in any of my usual summer luxuries – no traveling, no specialty ice creams. I spent a few weeks alone in my apartment after my roommate moved out, and spent a lot of time preparing for someone new to move in. And, for the first time since this pandemic started, I faced a significantly reduced income, with the extra $600 in unemployment benefits expiring at the end of July. Still, it remained important—perhaps even more so—to have a plan for my money.

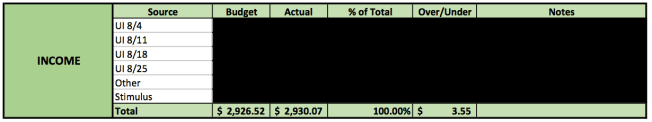

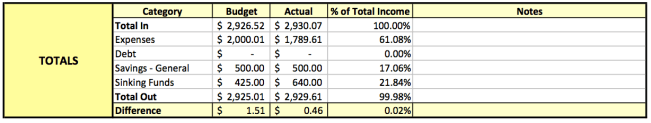

In August, I brought in $2,930.07. While this is pretty much the amount I was expecting, it’s still a significant reduction from July, even as it’s bolstered by the fact that I was (finally) able to budget for my $1,200 stimulus check delivered by the CARES Act.

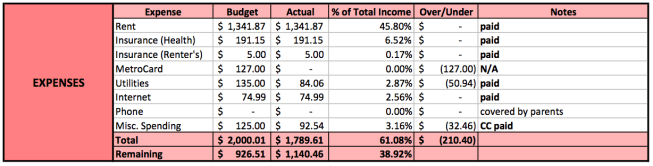

My rent, health insurance, and renter’s insurance remained consistent at $1,341.87, $191.15, and $5, respectively (even though he moved out, my roommate continued to pay his half of the rent for the month, since he had signed a lease with me through September 2020). I did no traveling via the subway so my transportation costs were $0, as was my phone bill since that’s graciously covered by my parents.

My utility bill (electric/gas) was over $50 cheaper than last month (!!!) at $84.06, likely reflective of the fact that I spent August living alone. These savings were somewhat offset, however, by the fact that this was the first month I had to pay for the WiFi, at $74.99. Previously, my roommate had covered the internet while I covered the utilities, but, seeing as he’s now gone, I’m covering both bills.

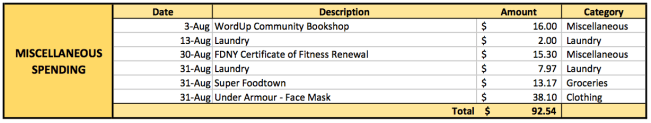

I’ve been spending so little on variable and discretionary expenses over the last few months that I’ve forgone breaking them down and, instead, lump my remaining spending into a “miscellaneous” category. Here, I spent $92.54. This included $9.97 on laundry, $13.17 on groceries, $38.10 on a face mask from Under Armour, $15.30 to renew a certification I need for my job (which I decided to move ahead with, even though it’s very unclear if/when my job will be returning), and $16 on a book from a locally owned bookstore.

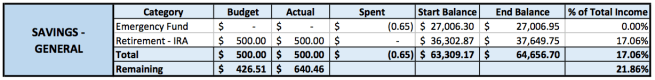

I decided to leave my emergency fund as is this month, as it’s in a pretty comfortable spot and I have a few other goals I’d like to try to meet this year. I set aside $500 for my IRA, which keeps me on track to max it out for 2020—a goal I hadn’t initially been aiming for, but I added to my list once I was furloughed and, therefore, no longer contributing to my 401(k).

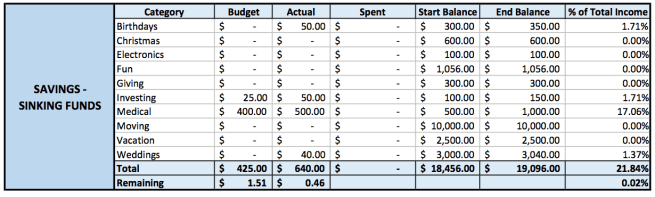

I put the bulk of my remaining money into my medical sinking fund, which is intended to cover my deductible and any other medical costs (copays, prescription costs, etc.) that may come up. I put a small amount into my investing fund, because I’m working on getting my feet wet with investing this year.

I also contributed small amounts to accounts that are otherwise considered “fully-funded,” since I had some extra money and am expecting some spending from these funds over the next few months. I added $50 to my birthday fund to cover any expenses from a birthday I’ll be celebrating in September, and $40 into my weddings fund because I (currently) am expecting to attend a wedding in November.

Of the 2930.07 I brought in, 1,789.61 (or about 61%) went to my expenses, while $1,140.00 (or about 39%) went to my savings. I had a remainder of $0.46 left over, meaning this isn’t truly a zero-based budget. But because I like to deal with whole, round numbers, I usually have a bit left over each month that remains in my checking account and works as a buffer.

Despite August being my lowest-income month yet in 2020, I still was able to put a solid chunk of money towards my savings—mostly thanks to that stimulus check. The next few months, however, will continue to be rocky, as I wait for any action from congress regarding continued unemployment aid and/or seek out other sources of income to help tide me over until this pandemic subsides and theaters are able to safely reopen.