Thanks to the latest round of stimulus checks, April actually turned out to be a pretty good month. Not only was it my highest-earning month yet of 2021, but it also brought about a major financial milestone. Read on to find out what it was!

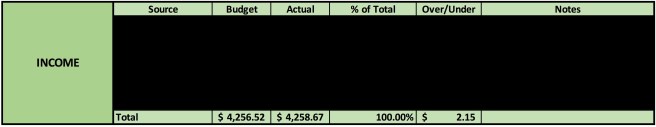

Though I have the specifics of my income blocked out for privacy, you can see that I brought in $4,258.67 in April – about on par with what I was expecting. A significant portion (about one-third) of that comes from the $1,400 stimulus check that I received this month (well, I actually received it at the very end of March, but after I had closed out that month’s budget, so I decided to just include it in April’s budget instead).

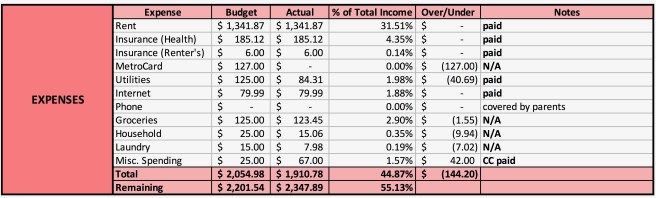

I spent a total of $1,910.78 on my regular living expenses throughout the month. Many of these (my rent, health/renter’s insurance, and internet) remain consistent month to month, and are therefore easy to budget for, and I try my best to stick to my budgeted amounts in my variable categories as well. The two outliers in April were my utility bill, which was about $40 less than I was expecting (keeping up a trend that started in March), and my miscellaneous spending category, where I overspent by $42 – so, hey I guess everything evened out!

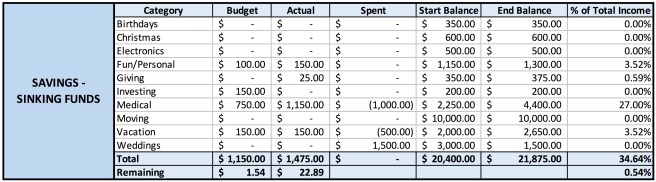

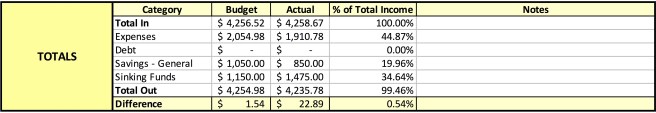

After covering my expenses, I had $2,347.89 left to save or invest. I invested a total of $750 ($250 into my new index fund and $500 into my IRA), and put $100 into my opportunity fund, to get that total to the nicer-sounding number of $7,500.

This is also where you’ll see that major milestone I mentioned: this month, for the first time ever, my IRA balance surpassed $50,000! A couple of years ago, it became a goal of mine to have that account hit $30K by the time I turned thirty, so to see it reach $50K while I’m still in my twenties is very, very exciting. I’m excited to see how much it can grow before I begin my next decade…maybe I’ll even be able to double my initial goal!

The remainder of this month’s income ($1,475) went towards my sinking funds: $150 to fun/personal, $75 to giving, $150 to vacation, and $1,150 to medical. My current financial priority is getting my medical sinking fund fully funded, which is why that line item saw the bulk of this month’s transfer.

You’ll also see that I shifted some money around this month. I entered this year with $3,000 in my weddings fund, an amount that I’d saved up in anticipation of a destination wedding I was supposed to attend last year. Because of the pandemic, that didn’t happen, and I’m not sure if/when the couple plans to hold a delayed celebration – if they do, though, it likely won’t be anytime soon. So, I moved half of that money elsewhere, dividing it between my medical and vacation funds.

After all was said and done, I ended up spending about 45% of my income on my monthly expenses, with the remaining 55% either going towards savings or investments. Like, I said, it was a pretty good month – hopefully May will continue the trend!