I took some time away from these budget reports as 2020 ended and 2021 began, as I grew busy with some other things that took precedence over this blog. But I’m back, and I’m excited to take a look at how things have changed as we wrap up the first quarter of the new year.

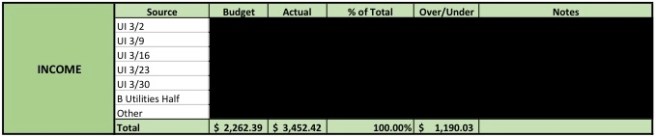

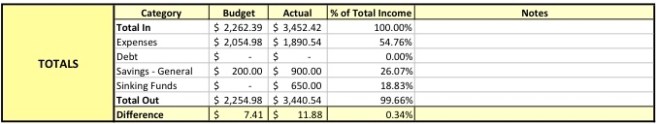

This month, I brought in $3,452.42. This is substantially more than I had budgeted for, mostly because this was a transitionary month with my unemployment and I wanted to make sure that I under-budgeted rather than over-budgeted. But everything worked out in the end, and it’s always exciting to end up with more than you’re expecting!

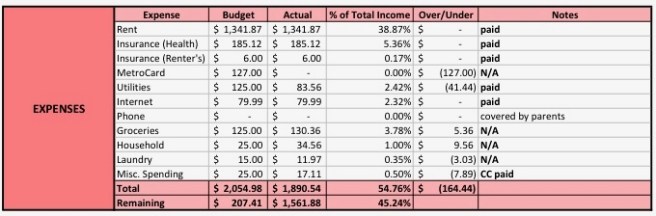

I spent $1,890.54 this month on my regular expenses. This includes both my fixed costs (rent, insurance, WiFi) as well as my variable expenses (groceries, utilities, household, etc.). If you’ve been following these budget reports for a while, you’ll notice I’ve made some changes in 2021. I used to group nearly all of my variable spending into one line item and would categorize it in a separate spending tracker within my budget, but I now break down most of these categories right in the expenses section. It provides a clearer, more accessible look at how much I’m spending on certain necessities (like food), so I’m very happy with this change.

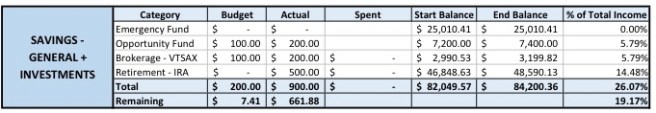

You’ll notice another change as we move on: the “Savings” section is now “Savings and Investments.” After reaching my goal balance for my emergency fund in 2020, I’ve started looking more into investing. One of my major financial goals this year is to max out my IRA, so I’ll (hopefully) be contributing $500 every month, and I also opened up my first index fund (!!), investing in Vanguard’s Total Stock Market Fund. I’ve also started putting some money towards an “Opportunity Fund,” which is sort of like a sinking fund but is likely going to be used for some sort of larger purchase (such as an eventual down payment, tuition for graduate school, etc.) This month, I saved $200 to the opportunity fund, and contributed $200 to VTSAX and $500 to my IRA.

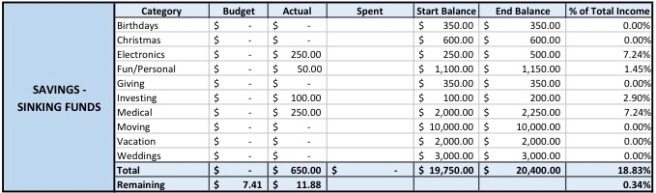

Finally, I saved a total of $650 this month towards my sinking funds, with $250 going to electronics, $50 going towards fun, $100 towards investing, and $250 towards medical. The fun fund is technically fully funded but I’m still contributing a tiny bit each month so I can really treat myself when the pandemic is over, and the investing fund is to build up the minimum necessary to open another index fund (around $3,000 in many cases).

So, all in all, I spent about 55% of my income this month, and saved or invested about 45%. In an ideal world, my savings rate would consistently be at least 50%, but five points less than that is nothing to scoff at. Plus, there’s always a bright side: with the latest stimulus check, things are looking like they’ll be even better in April!