November is typically my favorite month of the year. The weather turns suitably crisp, the autumn leaves reach peak vibrancy, and I get to celebrate one of my favorite holidays: Thanksgiving! But this November—like the rest of 2020—was somewhat different, and I didn’t get to partake in all of the fall traditions that I usually enjoy. I did, however, still budget—that’s one thing 2020 hasn’t taken away!

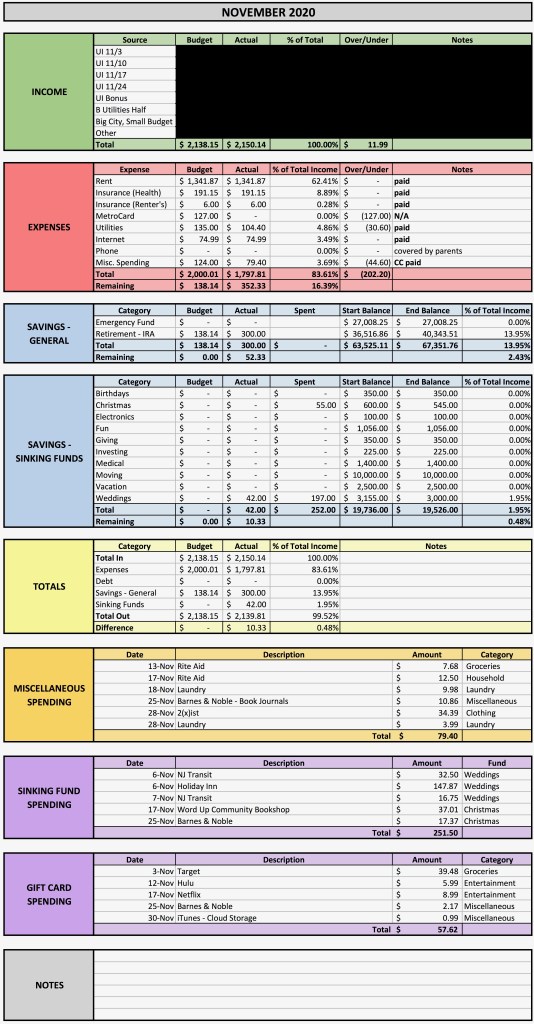

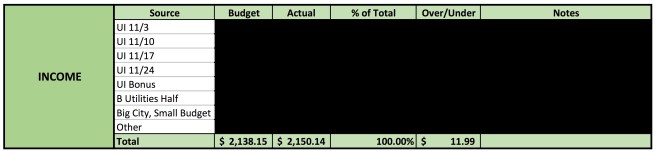

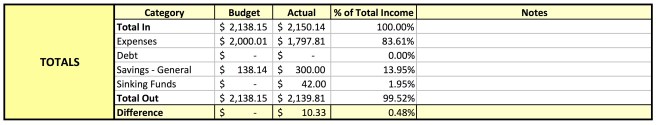

I brought in $2,150.14 for the month, making this my lowest-income month yet in 2020. The majority of my income, once again, came from my unemployment insurance, which included a payment from the beginning of the pandemic that never got transferred over to my bank account. I also made a few sales on Etsy, which is very exciting! Please consider checking out my shop; I sell the budget template seen throughout this post, as well as several others!

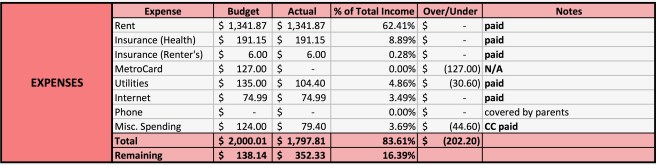

I spent $1,797.81 on regular expenses in November. I live in a two-bedroom apartment and split the costs of rent, utilities, and internet with my roommate. When budgeting my expenses, I account for only my half of the rent, but for the full amounts of the utility and internet bills; whatever my roommate owes me for those bills is included in my income.

For consistency’s sake, I’m continuing to budget for an unlimited monthly MetroCard, even though I haven’t spent that much on the subway since March and likely won’t again until the pandemic is over. My parents generously cover my phone costs (I’m still on the family plan), but I always include this line item as a reminder to (1) be grateful and (2) be aware that this is a cost that, at some point, I’ll need to start paying.

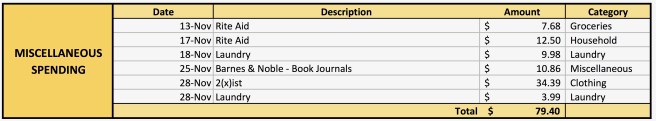

My miscellaneous spending—which I use to account for pretty much all of my variable monthly spending—was fairly light this month, at $79.40. This includes money spent on groceries, household items, and laundry, as well as anything discretionary (which, this month, came in the form of two Black Friday purchases).

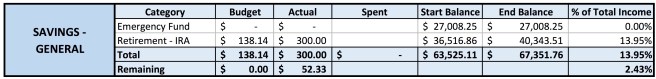

Because this was a lower income month, I didn’t have as much left over to save as I would have liked. I set aside $300 for my IRA this month, and, though this is more than the $138.14 I had initially budgeted, it’s less than the $500 that would have kept me on track to max out that account this year.

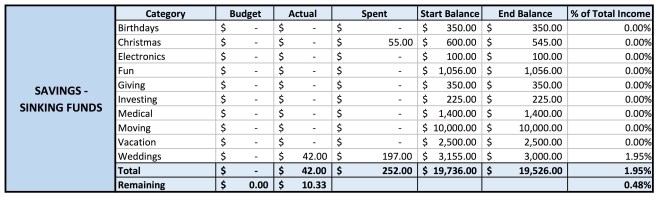

Even less went to my sinking funds this month; in fact, this was the first month of 2020 that I spent more from my sinking funds than I contributed. My contributions totaled $42 (to my weddings fund, to get it back to my goal balance of $3,000), while my spending totaled $252 ($197 spent on costs associated with attending my sister’s wedding, and $55 on Christmas gifts).

With an income of $2,150.14, expenses of $1,797.81, and $342 put towards savings, my savings rate for this month was just shy of 16%. While this isn’t ideal, it’s more than I had originally budgeted—and certainly better than 0%! This month was also a good reminder of why I utilize sinking funds: I was able to attend my sister’s wedding and get a head start on my Christmas shopping without once worrying about where that money would come from our how it would affect my budget.

That’s all for November. Check back next month to see how I spent my money in December, AND to see how I budgeted for Christmas!