We’ve officially entered my favorite time of year. October always gets me excited: the leaves turning, the spooky movies, the knowledge that the holidays are waiting just around the corner. Historically, though, this also means that October is the time I begin to see my spending creep up, as I’m tempted by an onslaught of seasonal decor and activities. Let’s see how I fared in this strange year of 2020.

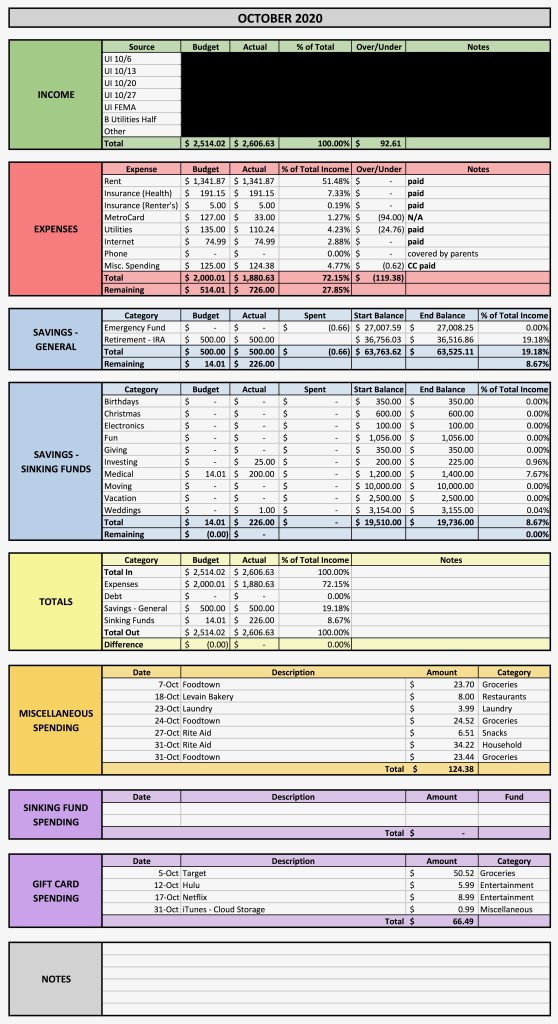

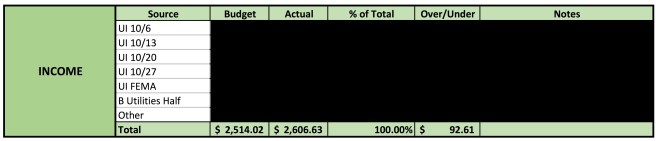

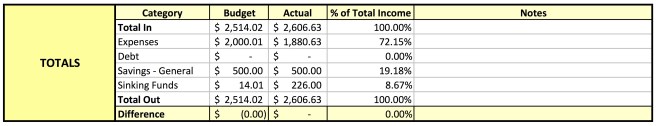

This month, I brought in $2,606.63. The majority of that was from my unemployment benefits, which were somewhat increased this month as New York paid out the second half of the FEMA boost provided by the President’s executive order from back in August. I also received money from my roommate to cover half of the utility/internet bills, as well as a bit of income from some other, random sources.

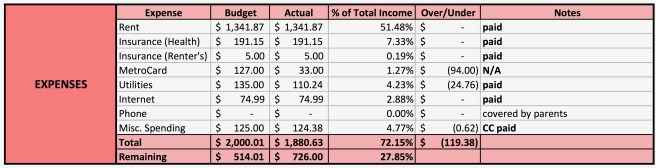

I spent a total of $1,880.63 in October. My biggest expense was, as usual, my rent ($1,341.87), followed by my health insurance premium ($191.15). The amounts listed for my utility ($110.24) and internet ($74.99) bills reflect their TOTALS, and not just my half of the bill, since I included my roommate’s half in my income. I also spent $5 on my renter’s insurance premium, added $33 to my MetroCard.

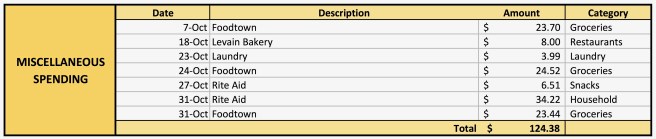

I spent $124.38 on variable spending, the breakdown of which can be seen above. The majority of it ($71.66) went to groceries (I also spent $50.52 on groceries at Target, but those were covered entirely by a gift card), with $34.22 going to household purchases and $3.99 to a laundry. I only spent $14.51 on truly “discretionary” purchases in October: $8 at a bakery with a friend, where we got cookies to take to a nearby park (so we could hang out while staying socially distant!), and $6.51 on some candy at Rite Aid, that I got after waiting in line for several hours to vote early in this year’s election.

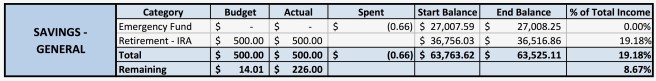

That left $726.00 to save. I put $500 towards my IRA, staying on track to max that out for the year—an important goal, seeing as nothing’s getting contributed to my 401(k) while I’m furloughed.

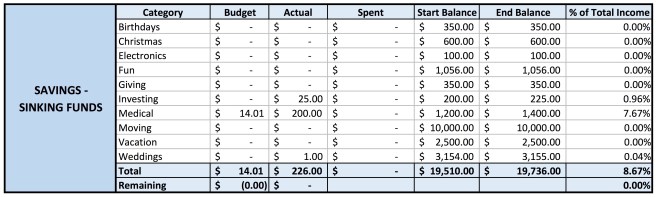

I distributed the remaining $226.00 to my sinking funds: $200 to my medical fund, $25 to investing, and $1 to weddings, since I figured I’d actually go for a true zero-based budget this month and wanted to get the balance in that fund to be a multiple of five.

Looking at my totals, I spent about 72% of my income this month, and saved 28%. While this is my lowest savings rate thus far in 2020, I’m not going to beat myself up. I still remained on track to achieve my biggest remaining savings goal (maxing out my IRA), and I’m proud of the work I did limiting my discretionary spending, without feeling deprived or dissatisfied. Hopefully we can continue that trend through November.