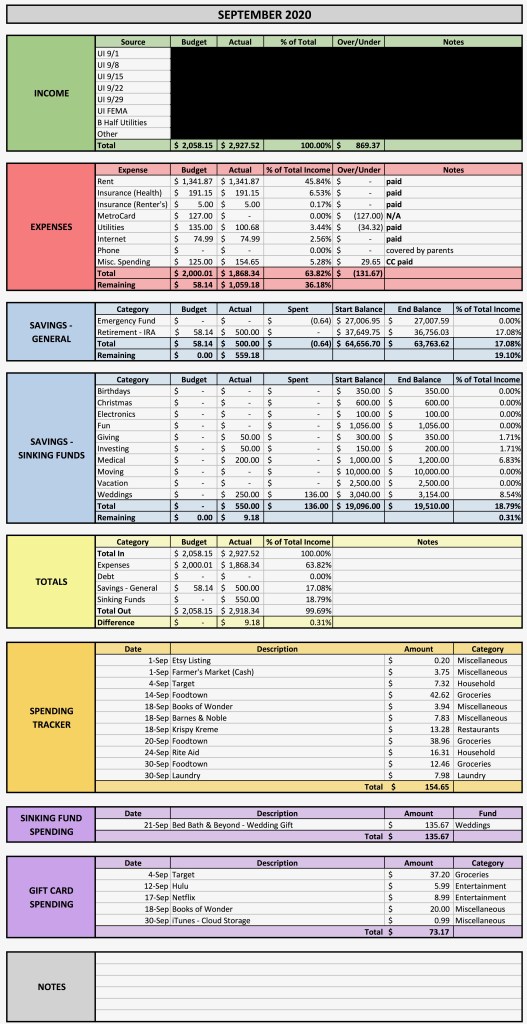

September may have brought with it a new season and some cooler weather, but it didn’t bring many changes to my budget.

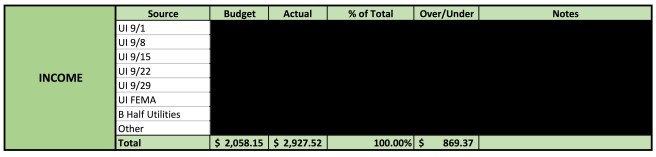

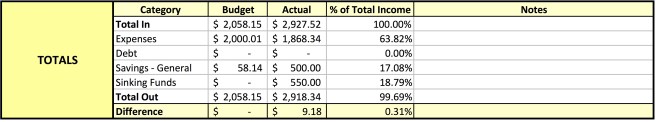

My income was pretty much on par with August, at $2,927.52 (I keep the individual amounts blocked out for a bit of privacy). This is significantly higher than I had been anticipating, however, as I had budgeted to bring in just over $2,000 for the month. The increase came from three weeks of the FEMA boost to my unemployment, which was paid out towards the end of the month, and from the fact that I’m now splitting the cost of utilities and internet with my new roommate.

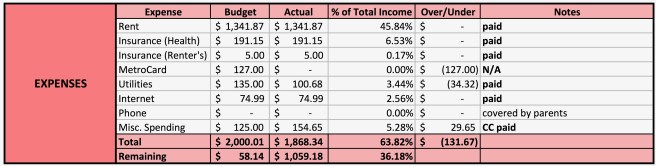

I spent $1,868.34 on my monthly expenses. This includes my rent at $1,341.87, my health insurance premium at $191.15, and my renter’s insurance premium at $5, all of which remain the same month after month. I continue to budget the full cost of an unlimited monthly MetroCard even though I’m not currently working or riding the subway very frequently, just for consistency’s sake. I didn’t factor the cost of the utilities/internet split into my budget, so these numbers represent the entire bill, not just my half: $100.68 for electricity and gas (this was lower than I had been expecting) and $74.99 for internet (this is the same every month). I may continue to do things this way, as I feel like this helped me reign in my spending even more and convinced me to send my roommate’s share directly into my savings. My parents graciously cover my phone bill so I spent no money there.

I no longer split up my remaining money into various categories because I’m mostly spending it on groceries and household items. I may begin splitting things back up once life becomes more normal and I start spending on restaurants and entertainment again, but, for now, this works. I spent $154.65 in September on variable expenses. This included $97.79 on groceries, $23.63 on household items (paper towels, tissues, etc.), $7.98 on laundry, and $25.25 on some books, an Etsy posting, and a visit to the new Krispy Kreme store in Times Square (it doesn’t take much to keep me happy!). I also used gift cards this month to pay for a grocery run at Target and to pay for the bulk of my purchase at Books of Wonder (this is an awesome independent bookstore specializing in children’s books in NYC…check them out online or if you’re ever in the city!).

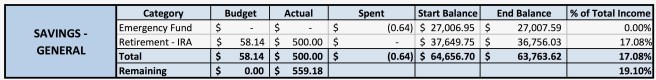

I put $500 towards my Roth IRA this month, keeping me on track to be able to max it out for 2020. I keep that money in the same account as my sinking funds and make one lump contribution at the end of the year (rather than monthly), which is why the monthly ending balance doesn’t factor in that $500. I’m currently looking into switching to monthly contributions, to help capitalize on compound interest.

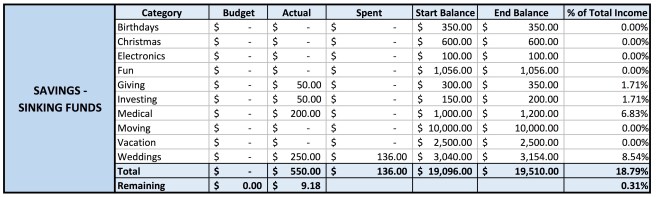

When I made my initial budget, I didn’t think I’d be contributing anything to my sinking funds this month. But because I saw that spike in my income, I was able to contribute $550: $50 to giving, $50 to investing, $200 to medical, and $250 to weddings (a portion of this was used to replenish the $135.67 I spent on a wedding gift this month).

So, out of the $2,927.52 that I brought in, I spent $1,868.34 (about 64%) on my monthly expenses, and saved $1,050 (about 36%). Because I like nice, round numbers, this isn’t technically a zero-based budget, as I had $9.18 unaccounted for, which remains in my checking account as a buffer. While I generally like to save at least forty percent of my income, I know that circumstances are different right now, so I’m just grateful to be saving any amount! And, hey—it was more than I had originally budgeted, so I’ll take that as a win.

If you liked this budget report and are interested in the budget template I use, you can purchase it from my Etsy shop here.