When I first began budgeting, I became addicted to watching budget report videos on YouTube. The knowledge and information these videos contained were invaluable to me; they helped me determine and plan for my monthly expenses, illustrated the power of a zero-based budget, and, perhaps most importantly, showed me that budgeting will set you on the path towards your financial goals, regardless of your income.

I’m excited to start sharing my own budget reports here on Big City, Small Budget. Each month, using my real numbers, I’ll show you how much money I brought in, and how that income was either spent or saved throughout the month. Hopefully, these reports will help others see the power of budgeting, and inspire them to get started on their own budgets—much in the same way YouTube inspired me. (And, if you need some help getting started, you can buy my monthly budget template from my Etsy shop!)

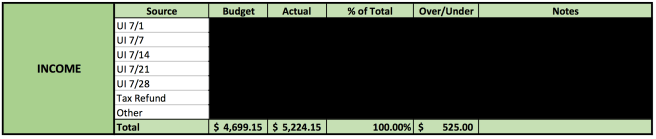

So, let’s jump right in: in July 2020, I brought in $5,224.15. This is a larger amount than is typical, primarily for two reasons: (1) I received five weeks of unemployment benefits rather than the usual four (I’ve been collecting unemployment since the theatre industry shut down in March), and (2) this month includes my 2019 tax refund. Below is my full list of income sources for the month of July (I’ve blacked out the individual amounts for privacy):

The first place I apply my income is towards my monthly expenses. This includes fixed costs, such as my rent, as well as variable spending on items such as groceries. When budgeting, I try to keep my total spent on expenses as close to $2,000 as possible.

Each month, I spend $1,341.87 on rent (I share a 2-bedroom apartment and split the rent 50/50 with my roommate), $191.15 on health insurance, and $5 on renter’s insurance. I’ve continued to budget the full amount for an unlimited monthly MetroCard ($127) since getting furloughed, although I’ve been using the subway much less. This month, I loaded $33 onto my card, which is good for twelve rides.

Heat and water are included in my rent, so, in terms of utilities, I pay for electricity and natural gas (for cooking). Because my roommate and I are spending most of our time at home, and because it’s the middle of the summer (meaning air conditioning), I raised my budgeted amount for this category from $100 to $135 for July—and even that wasn’t quite enough to cover the bill, which came out to $137.12.

I don’t budget anything for WiFi, since my roommate covers that bill. When we moved into our apartment, he opened the WiFi account in his name and I opened the electric in mine, and we just kind of fell into a pattern of each paying our respective bills rather than splitting their total. This does mean that there are months (such as this one) where I end up paying more, but I’ve accepted that this is the way we do things. Similarly, I don’t budget anything for my phone because I’m still on my parents’ family plan and they (very graciously) cover the costs for my line. This is slightly embarrassing to admit, as it makes me feel like I’m not a “real” adult, but I promised to share my real numbers here—full transparency!

This leaves about $200 to cover my remaining expenses for the month which, at this point, are mostly groceries. Since the pandemic began, I’ve been doing virtually no discretionary spending—no fun activities, no restaurants, etc.—which is why I’ve chosen not to break down my remaining expenses into specific categories. It’s easier for me to know that I have $200 to spend throughout the month, and to just subtract any purchases I make from that pot.

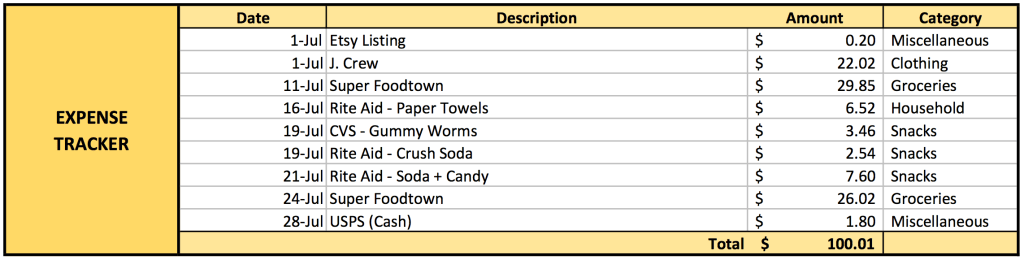

This month, I spent $100.01 of that $200: $62.39 on groceries and household items, $22.02 on a suit from J. Crew (I was able to cover the bulk of this purchase with a gift card), $13.60 on some impulsively-purchased snacks, $1.80 to mail something at the post office, and $0.20 to post my first listing on my Etsy shop.

So, my total amount spent on monthly expenses was $1,808.45, which left me with $3,415.70. Because I’m debt free, I was able to apply all of this money towards my various savings goals!

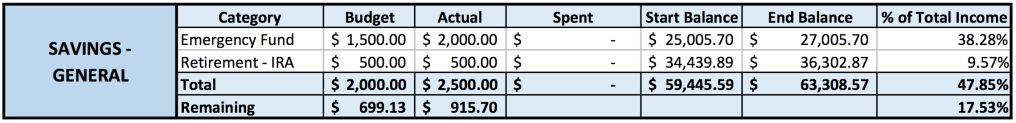

Earlier this year, I achieved my goal of funding my emergency fund to $25,000, which is roughly twelve months’ worth of expenses. This is more than the three to six months that most financial planners recommend, but it’s a number that makes me feel secure, which is a major purpose of any emergency fund. I initially planned to stop contributing to this account once I reached this goal; however, due to the amount of uncertainty in the world right now, I’ve decided to continue putting money aside for emergency use. Should I have an amount in excess of $25,000 once the pandemic subsides, I’ll redistribute the surplus to some of my other savings goals. I contributed $2,000 to my emergency fund this month.

I also contributed $500 to my Roth IRA. In the past, I’ve typically contributed anywhere from $100-$300/month. However, because I’m currently not working and, therefore, not contributing to my 401(k), I’ve decided to raise my IRA contributions. I’m hoping to max out that account this year.

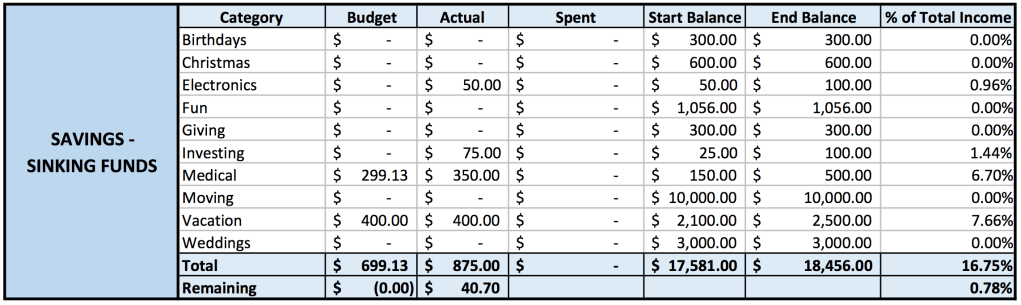

Finally, my sinking funds. I currently have ten sinking funds and, prior to this month, six of them were considered “fully-funded.” I was able to contribute to the remaining four in July, and even brought my vacation fund up to a fully-funded $2,500 with a $400 contribution. I also contributed $50 to my electronics fund, $75 to my investing fund, and $350 to my medical fund.

So, out of the $5,224.15 that I brought in in July, $1808.45 (or about 35%) went towards my expenses, $3,375 (or about 65%) went into savings, and $40.70 (<1%) was left unbudgeted. Generally, I like to leave a small amount unbudgeted each month to build up a cushion in my checking account. This means this isn’t exactly a zero-based budget, but it’s pretty darn close!

I’m very satisfied with my savings rate for July, although I know this won’t be the case going forward. The extra $600 in FPUC payments expired on July 31st, so my August budget report is likely going to look very different. Come back next month to see how everything goes, and don’t forget to check out my Etsy shop if you think you’ll find my budget template useful!